Google Ads can be a lot to keep up with.

You need to choose the right keywords, have strong ad copy, consider extensions, and choose your targeting, strategies, and bidding options well, which is why many companies work with a professional Google Ads agency.

Even with all of this, Google placements are never guaranteed. Neither are stable cost-per-click or cost-per-action prices. The impression share is always up for grabs, even if you’d been in a top slot for years, and an active market means that pricing can fluctuate quickly.

Everything happens behind the scenes in Google’s market, with all of the above factors taking an ad’s bid, quality score, and relevance into account.

Because all of this happens behind the curtain, so to speak, it’s difficult to know how your ads are doing in the impression share, particularly compared against your direct competitors.

That’s where Google Auction Insights can help.

In this guide, we’re going to dive deep into Google’s Auction Insights to go over what you can learn, how to navigate the tool, and how you can use this information to improve your campaigns moving forward.

What is Google Auctions Insights?

Google’s Auction Insights is a reporting tool for both Google Search Ads and Google Shopping Ad campaigns. It shows how often your ads appear compared to how often your competitors’ ads appear for your target placements.

This is invaluable information, and it’s all available relatively quickly. The data shows up a day after your ads were displayed, giving you an up-to-date look in near real-time at your campaign’s performance in terms of ranking. This can help you make immediate and accurate informed decisions based on that data so you can hopefully optimize your campaigns to be more competitive as needed.

Where to Find Your Auction Insights

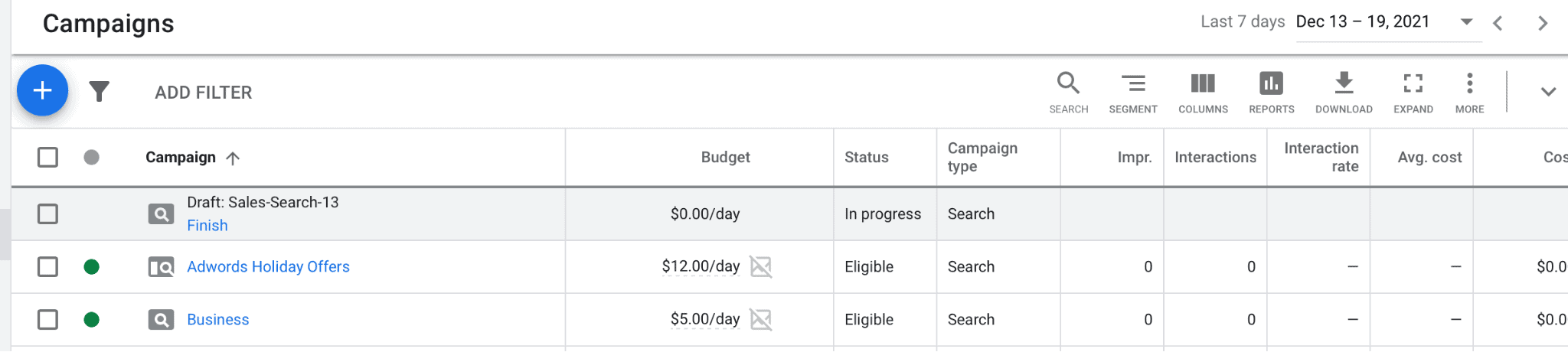

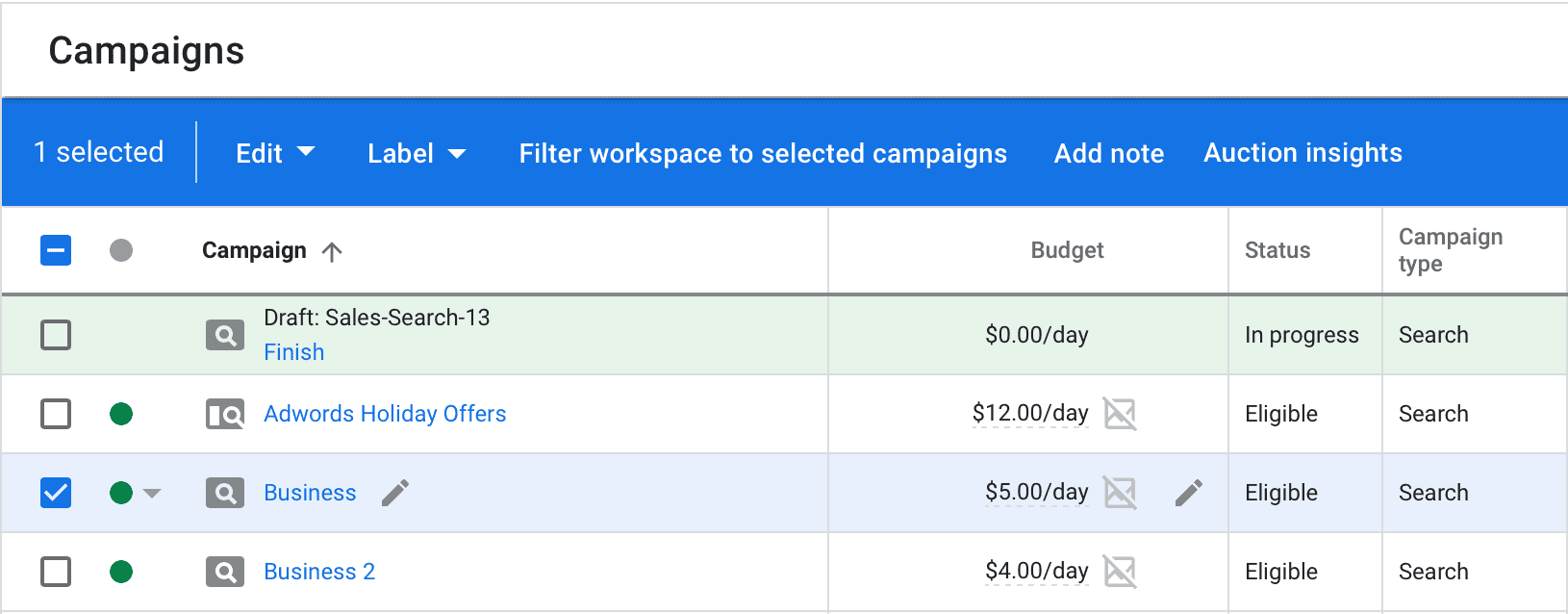

You can view Auction Insights for specific ad groups, keywords, or campaigns.

To do this, go to your Ads Manager, and then view the segment type that you want to review.

Then, click the checkbox next to the specific campaign, keyword, or ad group that you want to gain insights on. This will cause a blue bar at the top of the dashboard to light up, with Auction Insights all the way on the right. Click that.

As long as you have active campaigns running, this will give you everything that you need to know right here.

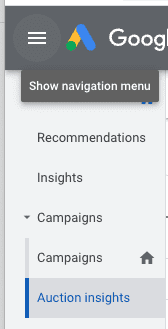

If you want to view the Auction Insights report for the entire account you can also navigate over to the left hand navigation menu and choose Auction insights under Campaigns.

The Auction Insights KPIs

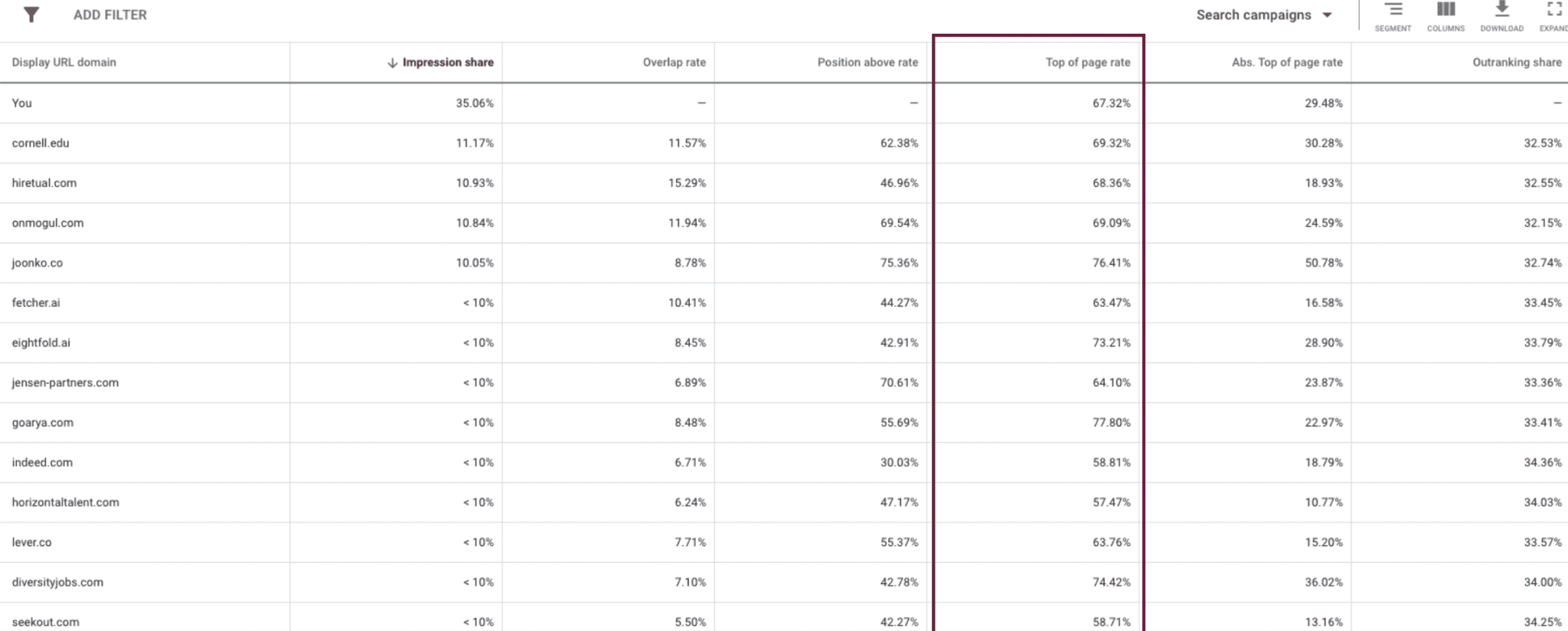

The Auction Insights can give you an enormous amount of information about how your campaigns are doing in the marketplace. Let’s take a look at the core key performance indicators (KPIs) that you can assess using this tool.

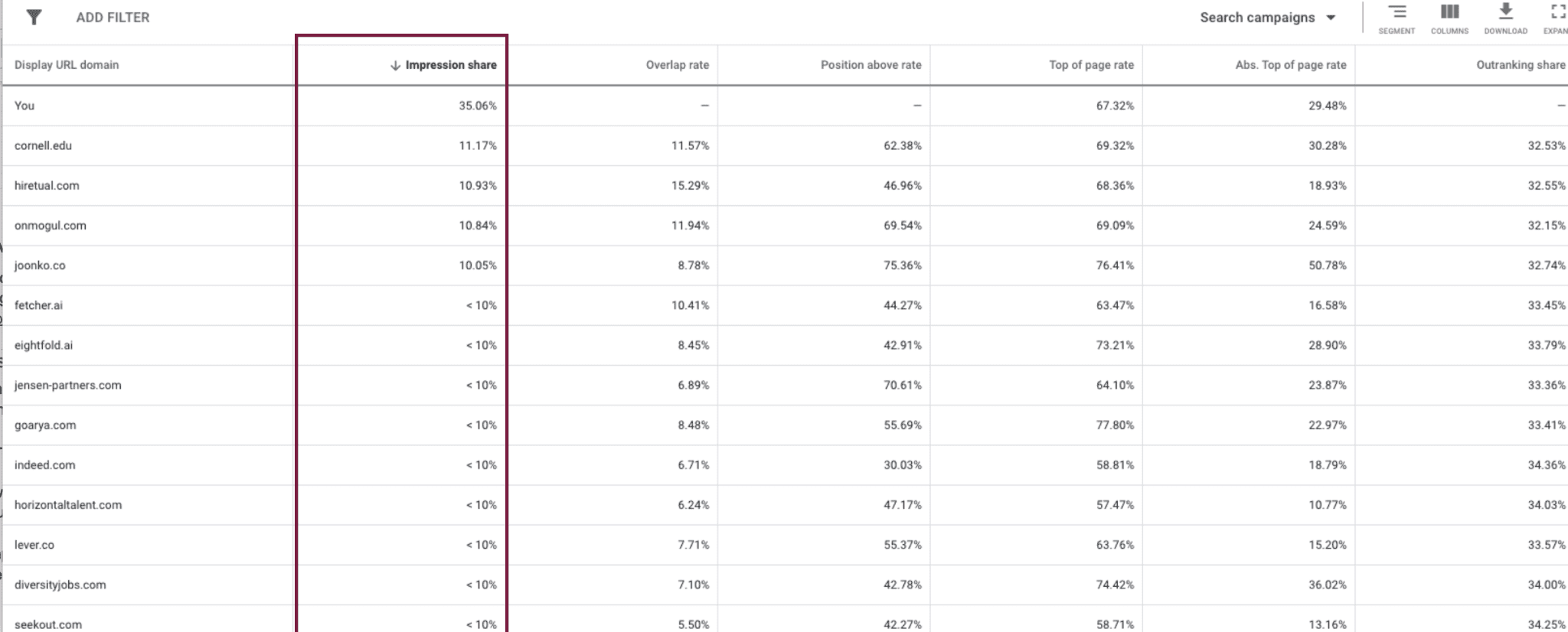

Impression Share

Your Impression Share tells you the total number of impressions you’ve received divided by the number of impressions you were eligible to get.

In other words, how often your ad showed up compared to how often it could have.

You always want your impression share to be as high as possible, because it means that you’re showing up more often for your target campaigns than not.

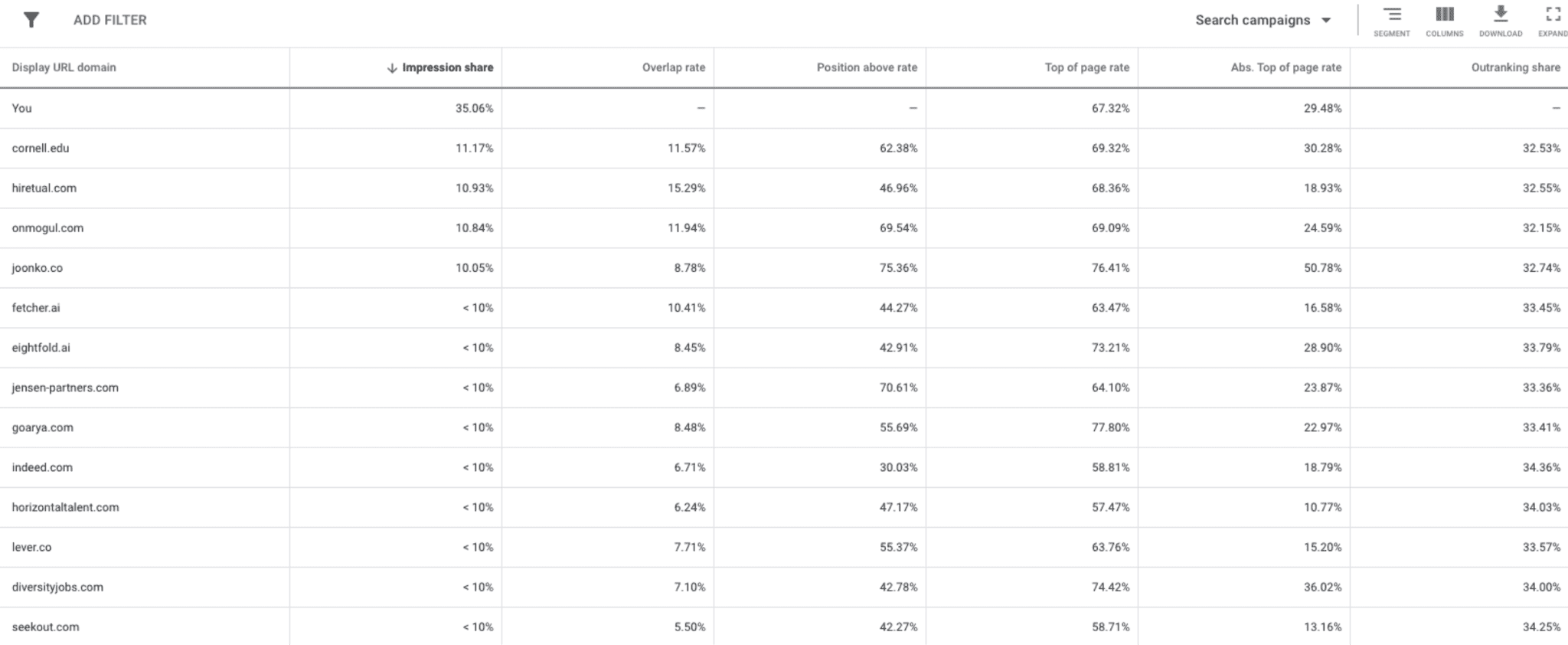

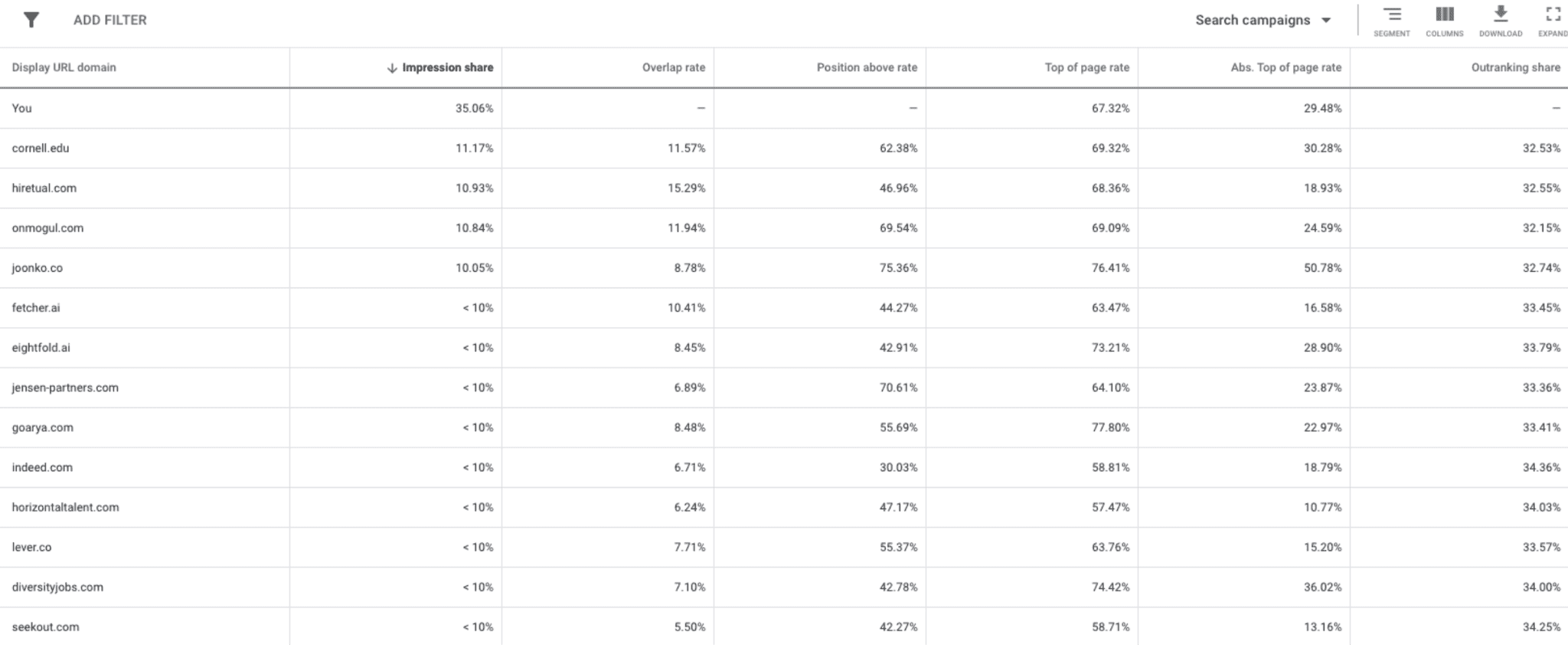

Your impression share, as you can see below, is going to be displayed as a percentage. That percentage tells you what percentage of the time your ad shows up when eligible to. Any impression shares under 10% will not be displayed.

Remember that impression share, in many ways, is directly correlated with ad spend. So while you can’t see how much your competitors are spending, you can get a vague idea of how much they’re investing by comparing their impression share to yours.

So if you have someone with an impression share of 40% and you’re at 20% and you’re spending 1k per day, they might be spending somewhere around 2k per day. While this isn’t even close to being exact (quality scores can increase ranking, deliverability, and reduce CPCs all at once), it’s a decent estimate to go off.

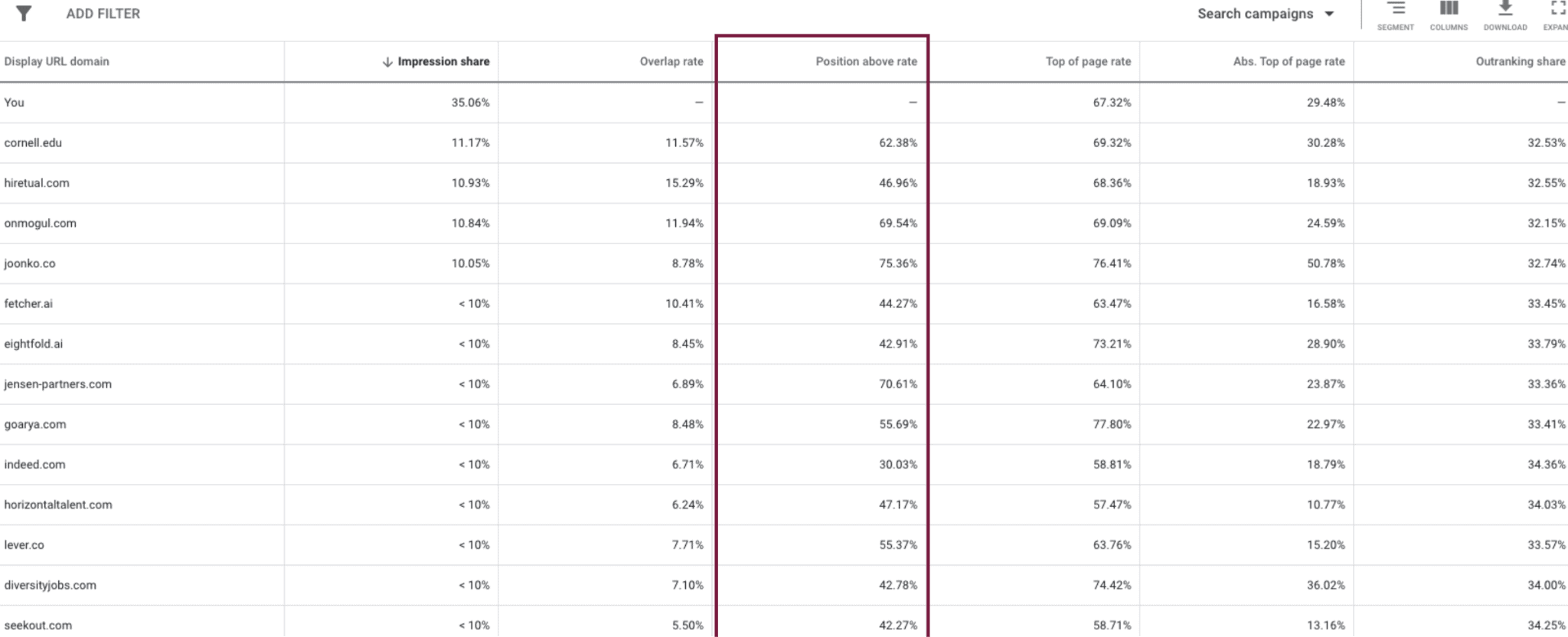

Position Above Rate

This shows you whose ads are earning those top-ranking ad slots when you’re in a direct competition.

When both ads are shown at the same time, how often did another advertiser’s ad come in a higher ad position than yours? This is what that number tells you.

So if you see a competitor’s position above rate at 30%, that means that they’re ranking higher than you in 30% of SERPs that you both appeared in.

This can help you identify specific competitors that are consistently (or at least frequently) ranking above you in searches, giving you insight into who exactly you need to research more. They may be bidding more, have higher relevance for certain campaigns, or have a better quality score. Either way, it’s time to start researching to see how you can beat them and increase your ranking outcomes.

This is a Search Ads-specific metric in Auction Insights.

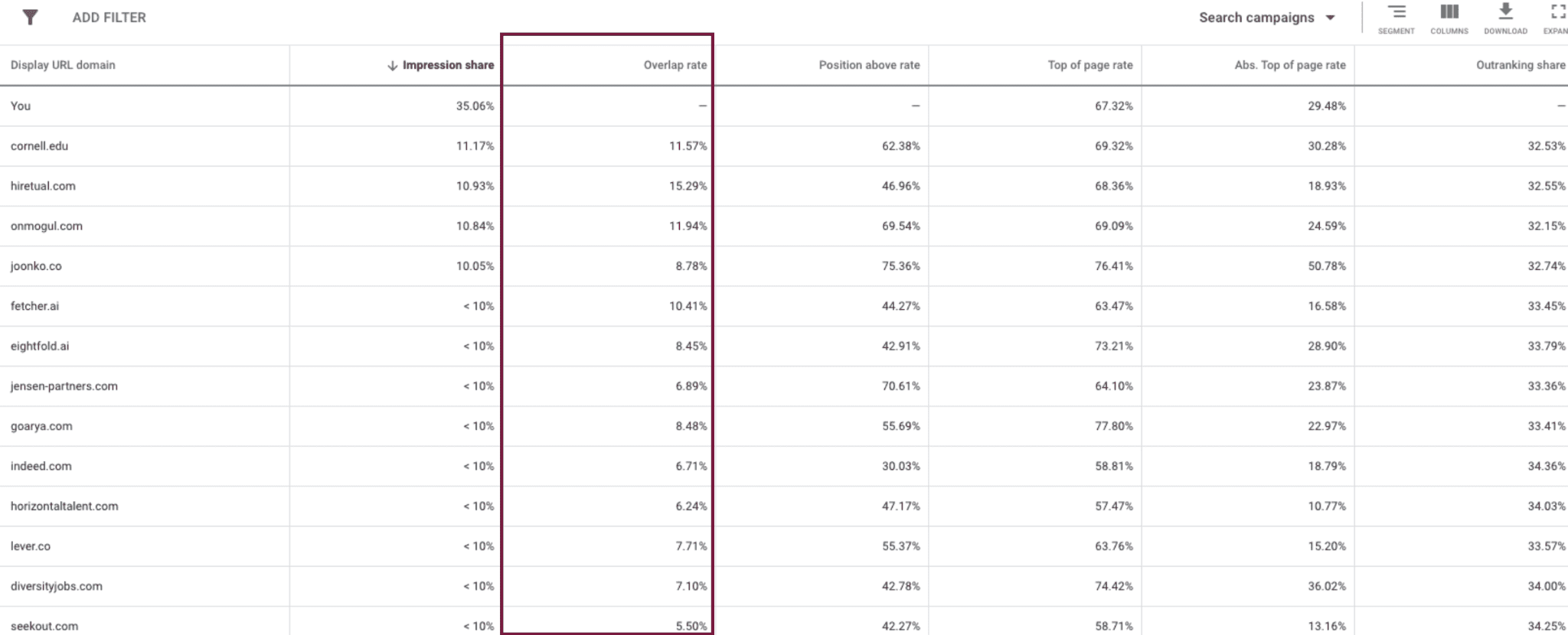

Overlap Rate

The overlap rate is going to show you the percent of times a competitor’s ad got an impression at the same time that your ad had an impression.

A mattress company like Purple, for example, will likely have high overlap with brands like Nectar, Casper, and TempurPedic, because they all have similar memory-foam offerings and are competing in the same space.

High overlap rates—which we’re going to define as 55% or more— indicates that there’s similar targeting, whether that’s similar product listings on Shopping or similar keywords for Search Ads.

Top-of-The-Page Rate

Your top-of-the-page rate tells you how often your ad appears above the first set of organic search results. Your TOTP rate and your competitors’ rates will appear in different columns, making it easier for you to identify top competition here.

Your TOTP rate can help you see how well your ads are ranking, and when compared to your overlap rate, you can get an idea of which competitors are beating you (and how often).

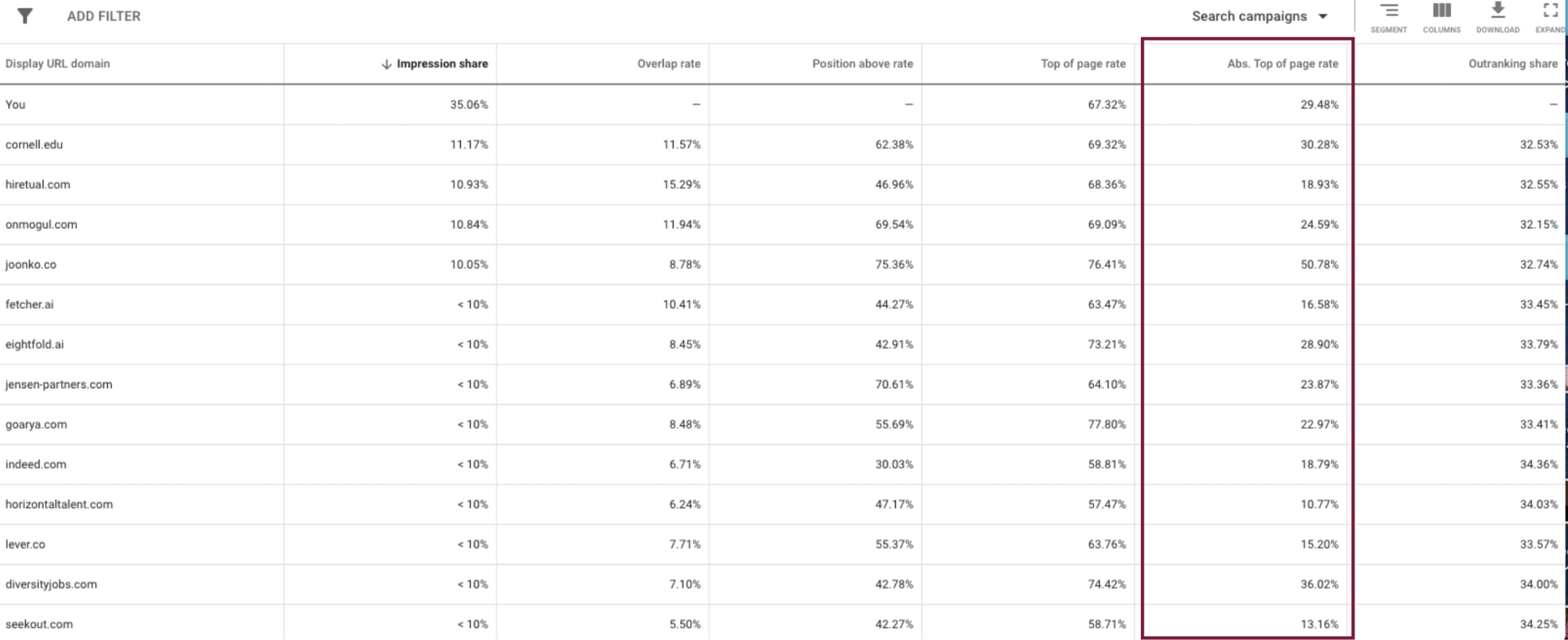

Absolute Top-of-The-Page Rate

Your absolute top-of-the-page rate is the percentage of ad impressions that appear at the very top of the search results.

You’re above not only other organic searches, but also any other ads, too. You’re looking at position 1 here.

Your absolute top-of-the-page rate will naturally be lower than your top-of-the-page rate, but seeing that you’re snagging some percentage here is a good sign that you’re on the right track.

If, however, you have an insanely high percentage for certain keywords or ad groups and they aren’t reliably sending in high amounts of conversions, you may also be bidding too much. Take a look and make sure that your bids and ad spend here is worth it if you’ve consistently got an exceptionally high absolute rate here.

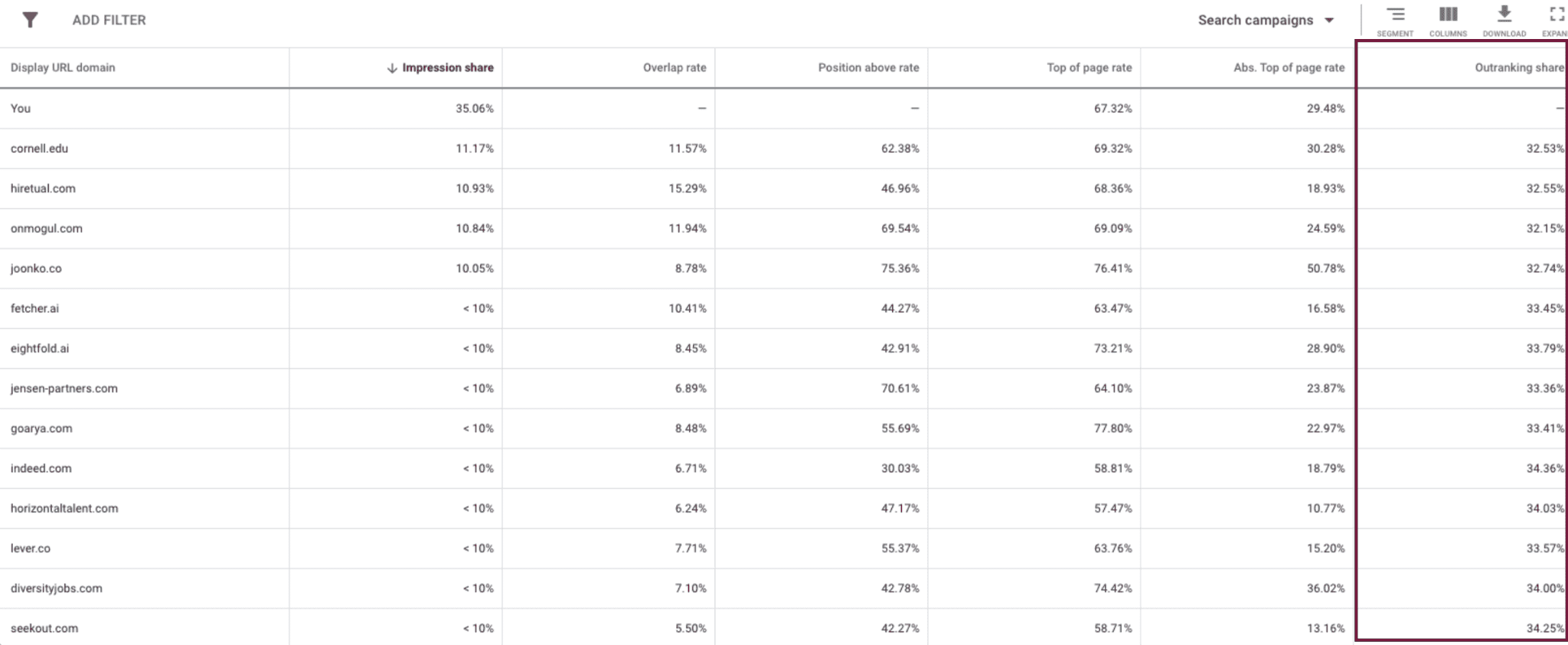

Outranking Share

Your outranking share is going to tell you how often your ad outranked a competitor’s. It will also show you when their ad didn’t show up at all but yours did.

This is an exceptionally useful metric because it shows you how you’re doing directly compared to other specific brands, and it can give you clues about how relevant your ads are compared to theirs when it comes to reach.

If you ever go in looking at how your brand is performing against the competition’s and you want to optimize your campaigns accordingly, this is a great metric to watch. This is true whether you’re adjusting the copy or trying to up your bid, and it can give you fairly direct feedback in almost real-time.

Why You Should Use Google’s Auction Insights

Google’s Auction Insights is a free tool, and in addition to the fact that there’s absolutely no catch to using it, it gives you one of the best and clearest looks into what’s happening with your competition.

Your ads don’t exist in isolation. Their reach and potential performance is all impacted directly by what your competition is doing around you; how they rank compared to you, how often they rank instead of you, and what they’re offering.

Google’s Auction Insights can help you close the gaps so that you can ideally improve your ranking, or at least understand your existing performance.

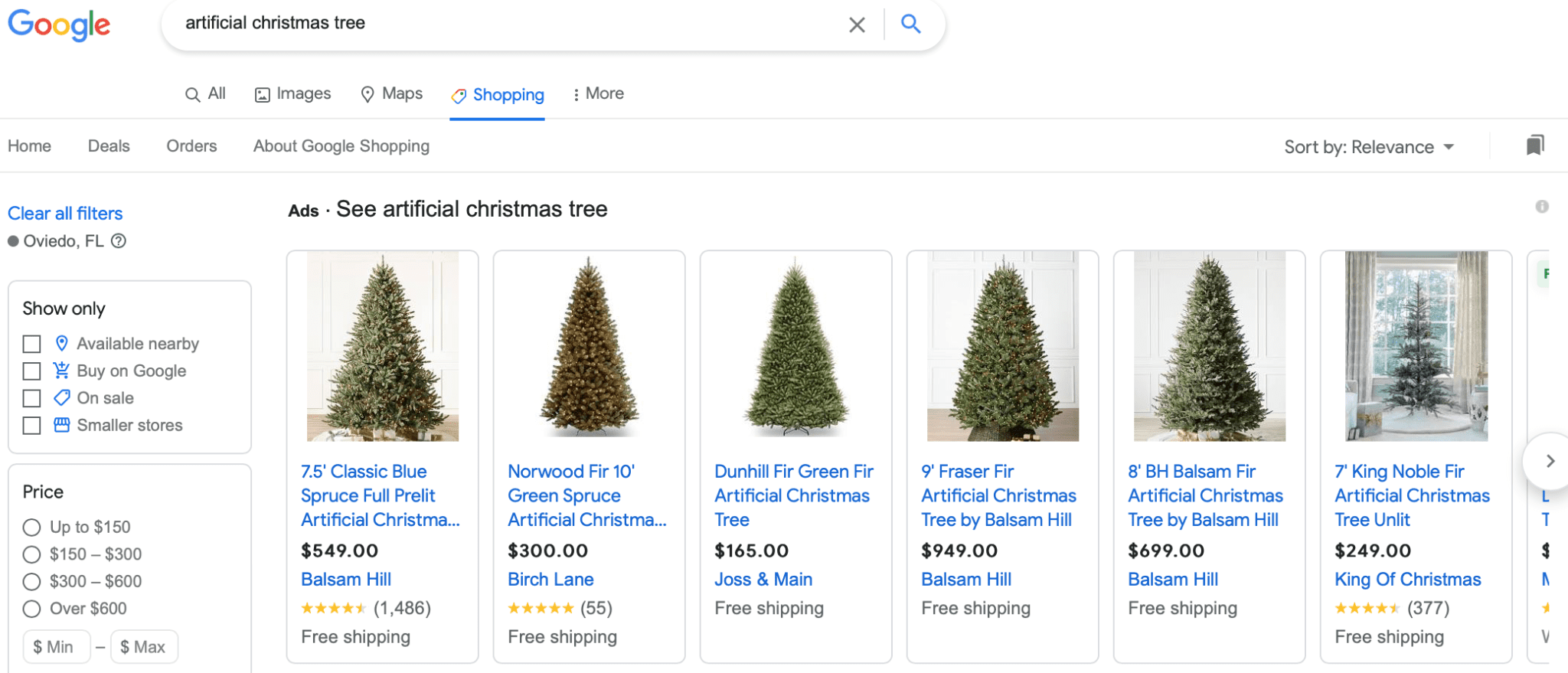

It’s available for both Search and Shopping Ads, where you’re surrounded by competitors trying to earn the same exact placements and clicks that you want.

You can also discover who your actual competitors are with search ads using this tool. It might be different than your primary competition “in real life.”

A local organic plant store, for example, might believe that another local nursery is their biggest direct competition online because they are offline, too. Google Auction Insights, however, might reveal that an online plant distributor with a large budget is actually their biggest competition, however, when it comes to Google Ads.

You can also get invaluable insights into your competition’s strategy: You can see the devices different competitors are targeting (mobile vs. desktop, for example), and what keywords the other brands are prioritizing and investing more in.

This can give you clues as to their primary offerings, their keyword strategies, and what keywords are most valuable to them. As a result, you can run tests of your own with campaigns dedicated to their high-value keywords if they align with your offerings and see if they work for your brand, too.

Are There Any Downsides to Google Auction Insights?

There really aren’t any downsides to Google Auction Insights. It’s free, thorough, and able to give you an abundance of actionable information you wouldn’t get elsewhere.

There are, however, a few potentially limiting factors that advertisers will want to keep in mind. These include the following:

- The data that you’re seeing is a day-old. This isn’t an enormous lag, all things considered, but it isn’t truly “in real-time.” Keep that in mind when looking at your reports, and remember that it will take a few days (and up to two weeks) to see the impact of things like a changed bid or updated keywords on your results as Google recalibrates.

- You’ll only see the impression share percentage when the keyword was active. If, for example, you paused your campaign for three days or had a day-parting schedule, you won’t see data from those off periods. That’s not counted to your impression share.

While this is relatively accurate, if you want to understand how people are ranking during the entire period during which your ads occasionally run, you won’t get that info here. - You can’t see match types that triggered impressions. You may be targeting exact match keywords only while a competitor is using phrase match, and they get more impressions (or, for some reason, vice versa). This can sometimes play a role in ranking or reach, but you won’t be able to see what match types are impacting campaigns here. (And remember: Google updated the broad match type option recently, so keep an eye on that performance, too!)

- Viewing total impressions for individual search terms it not an option. There’s detailed information based on geo-targeting or day-parting through your settings, but know that there are limitations about total impressions.

- It’s not possible to see which keywords are active for your competitors currently. While other tools can clue you in here, this isn’t something you can learn from the Auction Insights, which can be a disadvantage if you want to try to beat your competition at their own game.

What You Can Learn From Google’s Auction Insights

As I’m sure you’ve noticed, there’s a great deal that you can learn from Google’s Auction Insights. It all just comes down to knowing what exactly you’re looking at and knowing how to put that information to use.

In this section we’re going to take a look at the specific actionable takeaways you can get from the Auction Insights and how you can use it to improve or optimize your campaigns moving forward.

1. How Your Impression Share Measures Up

Google Ads reporting section can tell you what your impression share is, but using Google’s Auction Insights to see how your impression share measures up against competitors can tell you a great deal.

You might think that you’re crushing it by getting 5% of an impression share for a highly competitive keyword, only to see that there are several big players consistently hitting numbers like 20% or more for the same phrases. That could give you enough of an idea to increase your bid (especially if you’re using third-party tools to help assess how much you should bid) so you can be more competitive.

You want to be able to figure out why your ad isn’t showing up, either at all or as often as you’d hoped.

You may also realize that you’ve got a high impression share compared to others on certain keywords. If that’s working for you, you can keep an eye on that impression share percentage overtime to ensure that no one tries to dethrone you.

2. Who Your Competition Really Is

We mentioned this briefly before, but in many cases, your Google Ads competitors may not be who you expect. Knowing who you’re up against can help your campaigns a great deal.

A small carpenter offering custom furniture, for example, might think that big name brands like Haverty’s or Ethan Allen are their biggest competition. And in person, that’s true; they need to grab customers away from those big-name stores.

In reality, however, their biggest competition for Google Ads will be other custom furniture builders who can make and ship items nationally.

Knowing this can (and likely will) impact your campaigns. You might realize that you need to drive your USP home further, for example. Instead of simply saying “custom made furniture,” and leaving it at that, you might stress that you can do CAD designs or even do custom prints; this is what will help you stand out from these specific competitors.

Pro tip: If you’re monitoring your Google Auction Insights fairly regularly, you’ll notice when certain competitors drop out of the Google Ads game. This isn’t uncommon; plenty will scale up or down throughout the year, or pause their campaigns completely. You can potentially jump in to fill any holes they left behind.

3. Which Keywords Your Competition is Prioritizing

While you can’t just click on a competitor and view all of their active keywords, you can see which competitors have larger impression shares for the keywords that you’re reviewing.

A few minutes of clicking around and looking at keyword data means that you will likely be able to make a few valuable inferences, including which keywords they may be prioritizing based on impression share.

It’s common for advertisers to bid more on higher-value or higher-engagement keywords. If it gets them a lot of clicks that turn into leads, they’re more likely to increase the budget for that particular keyword group.

And while all brands run tests, if a core competitor seems to be consistently prioritizing certain keywords (or at least has a high impression share month over month), it may be worth testing to see how increasing a bid or updating your campaigns for that particular keyword can work for you.

4. If Someone Else is Bidding On Your Branded Keywords

Plenty of advertisers love the thought of having the chance to bid on someone else’s branded keywords in order to hopefully snag some of the traffic intended for the competition… but are less thrilled when they realize that other brands can do the same to them.

You always want to rank for your own brand’s keywords, especially if someone is trying to one-up you for your own keywords. Keeping an eye on impression share and the competition who is bidding on your brand’s keywords (which you can see if you’re also running a branded keyword campaign) is a good way to go, especially for brands with significant name brand recognition.

You can make sure that you’re bidding more when needed so that you’re outranking anyone trying to bid on your brand keywords, and so that you can dominate that particular impression share.

5. What Devices Your Competition is Targeting

Device targeting isn’t going to be relevant to every advertiser out there; in many cases, brands will advertise to all devices at once.

There may be a few cases, however, where you notice that your competition is intentionally targeting only certain types of devices for a campaign. If so, you may get insight into their strategy so you can optimize your own campaigns to outperform them.

A brand using a lead ad extension, for example, might choose to target mobile devices if they get better results using the extension than they do with landing page completion on desktops.

And an electronics store might create device-specific ads (either individually or using dynamic keyword insertion) and then target accordingly, helping them reach higher relevance and ranking.

6. When Your Competition is Scaling Up or Down

While some brands are in it for the long-haul when it comes to PPC ads, some competitors will come and go in the Google Ad landscape frequently. They may scale up or down, or stop Google Ad campaigns altogether for any number of reasons.

Budget, seasonality, and assessed value can all play a factor in whether the competition is increasing or decreasing Google Ads.

You’ll see ads from Balsam Hill (which specializes in Christmas trees and decor) running ads related to Christmas products all year. Large department stores, however, may only bid heavily on their holiday inventory and related keywords October through December, because it’s not their core focus or their biggest selling item other months of the year.

Knowing that your competition is scaling up or down gives you information that you can act on.

If you see a competitor suddenly increasing their impression share or outranking you on one of your valued keywords, it may be time to increase your bid, for example.

But if you also notice that they’re scaling back and you’re suddenly ranking in the top position frequently and have an enormous percentage of the impression share, it may be worthwhile to test decreasing your bid to see if you can still maintain strong performance at a lower cost to increase your overall ROAS.

7. If Your High Impression Share Also Means Outranking the Competition

One thing that many advertisers forget is that impression share isn’t everything in and of itself. It’s valuable, it’s important… but it’s not the only part of the equation that matters.

Your ad’s position matters, too. Top-ranking ads in the top few positions or the top page often receive far more clicks than those lower down in the search results.

You could be getting a solid impression share, for example, but consistently having your ads shown towards the bottom of the search results page. You can also have the same impression share as a competitor, but they get more clicks but they’re in the top slot and you’re fifth on the list.

Rank is determined by a number of factors, including relevance, quality, and bid, so take all of this into consideration if you think your position could be impacting your performance in a negative way compared to a competitor.

8. Low-Competition Opportunities

Choosing your keywords can be complex and difficult, and it must be strategic.

As a result, you might have three competitors selling the exact same product with vastly different keywords on their lists. There would likely be some overlap, but some may choose different variations of certain keywords due to cost, competition levels, or even their own audience’s dialects based on location, gender, or age.

When you’re looking through your Google Auction Insights, you might realize that certain competitors are ranking incredibly well (and often) for specific keywords. If none of your other top competitors are ranking for those keywords, it may be a low-competition (and thus hopefully low-cost) opportunity that’s worth investing more into.

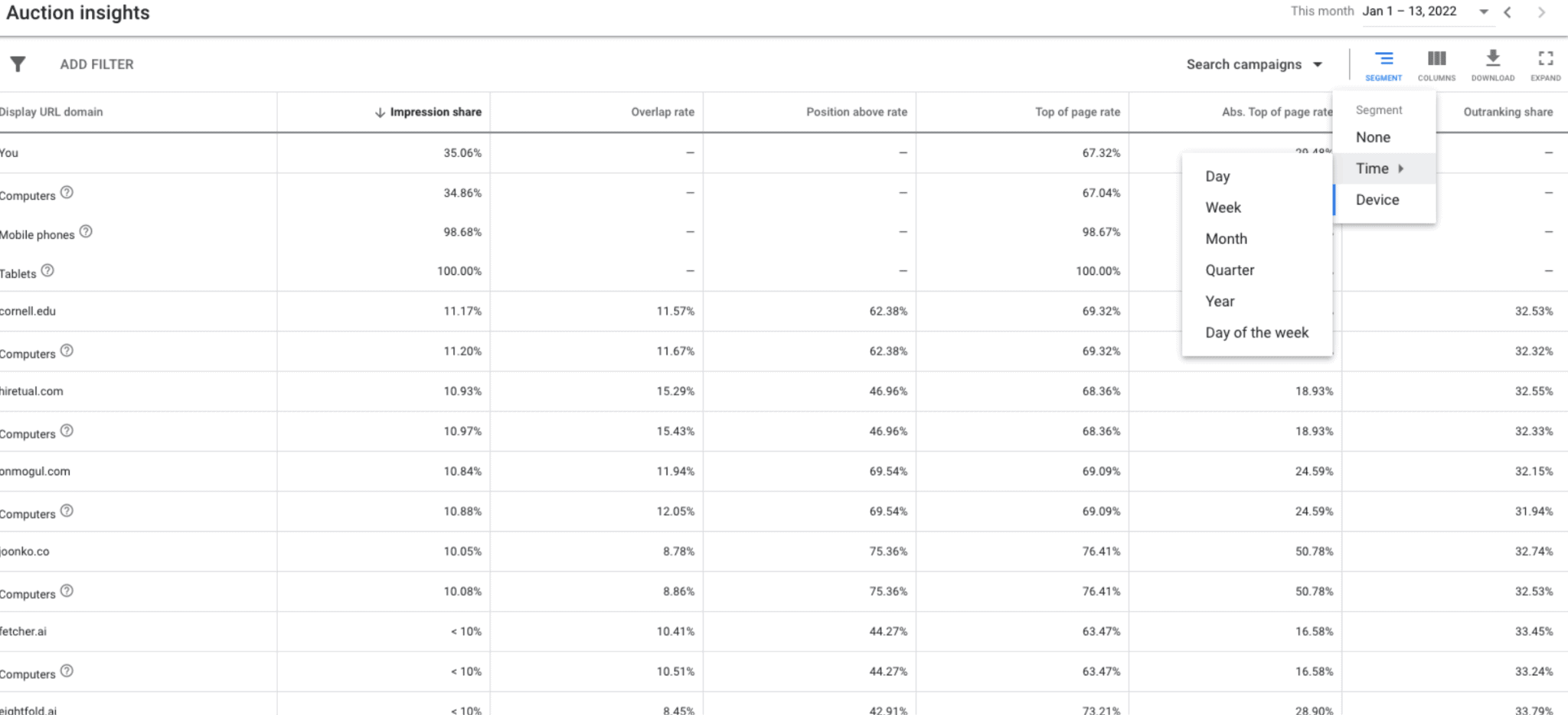

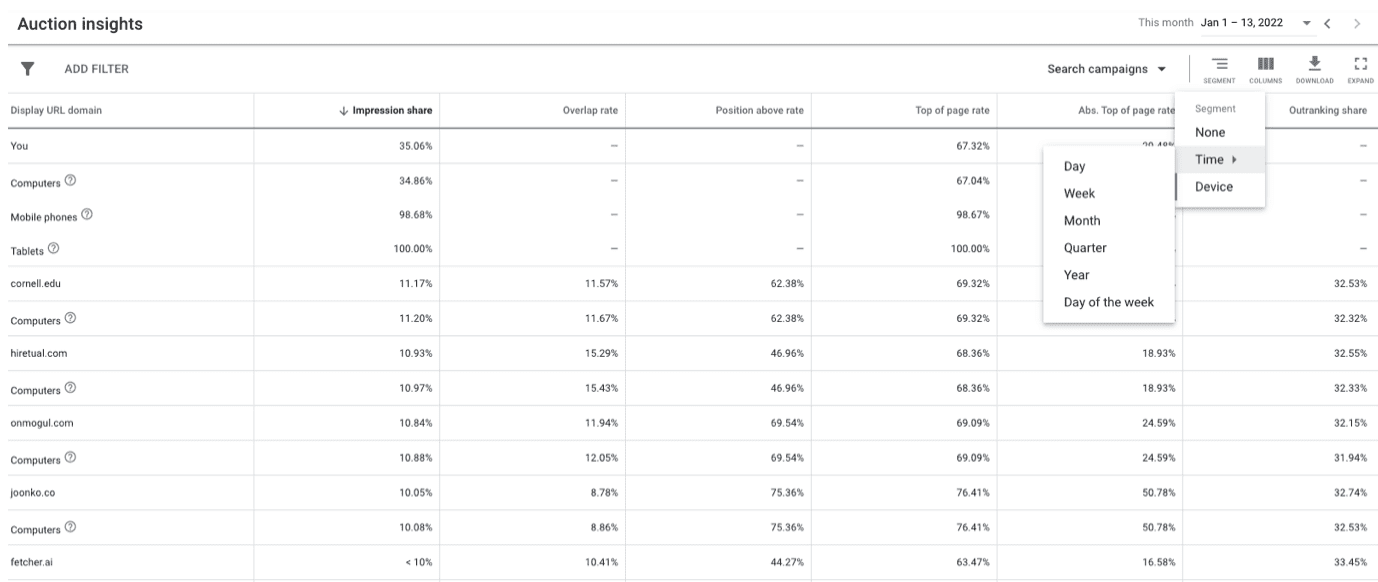

9. Assess Results By Time

Timing matters, and with an online marketplace that’s always in flux, it can be dead useful to know what results you and your competitors are getting…and when.

Google’s Auction Insights is aware of this, and as a result, they actually allow you to break down results by time.

You can see what the competitive landscape (and the data points we’ve discussed so far) look like broken down by day, week, month, quarter, year, or specific days of the week.

It would not be surprising at all to see different competitors showing up more in different quarters or years, but it may be surprising to see sudden shifts day-over-day or week-over-week.

Using this tool is an additional segmentation option that allows you to keep an eye on how your competition is changing as time moves on, and it may also give you a clue into what seasonal priorities they have.

Final Thoughts

Google’s Auction Insights can tell you a great deal about how your brand’s campaigns are stacking up against direct competitors… including competition that wasn’t even on your radar before.

While the tool does have some limitations, it also gives you an enormous amount to work with in terms of raw, actionable data.

And you can always take the baseline information about who your top competitors are and plug it into a third-party tool like SpyFu or Semrush to learn more about what they’re doing with their campaigns. To truly unseat a powerful competitor (or to at least become more competitive with them), this may be the best way to go.

In the meantime, remember not to make any decisions before looking at your existing CPC and ROAS data. Some keywords may work exceptionally well for your competition but may not work for you. Google Auction Insights just gives you a few more data points that you can take into account when you want to learn more about your specific market and how to optimize your campaigns accordingly.

Want to learn more about optimizing your Shopping Ad campaigns? Take a look at our Google Shopping Ads Hub for a breakdown of how to optimize your campaigns like never before.